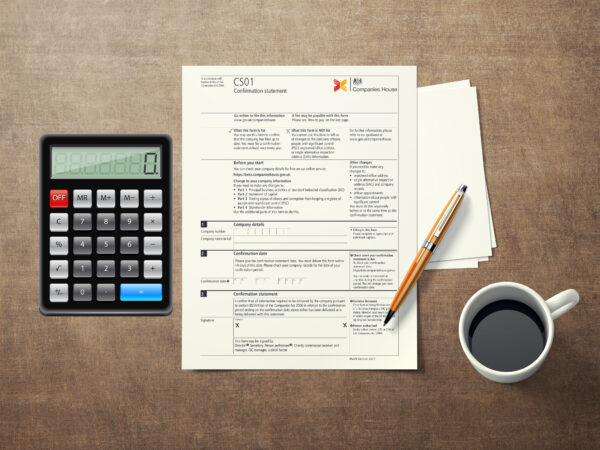

Filing a confirmation statement is a crucial task for every business owner in the UK. It ensures that your company’s information is up-to-date on the public register, which is not only a legal obligation but also essential for maintaining transparency and trust with stakeholders. In this guide, we’ll walk you through the steps on how to file a confirmation statement to keep your business compliant and avoid any penalties.

When it comes to managing your business, understanding the nuances of confirmation statements is key. These statements serve as an annual snapshot of your company’s details, including directors, shareholders, and registered office address. Ensuring that this information is accurate and up-to-date is not only a regulatory requirement but also a reflection of your company’s integrity and professionalism.

What is a Confirmation Statement?

A confirmation statement is a legal document that every UK company must file at least once a year. It replaces the annual return and includes essential information about your company. This information includes details about the company’s directors, secretaries, registered office, shareholders, and share capital.

Why Filing a Confirmation Statement is Important

Filing the confirmation statements is more than just a legal obligation; it’s a way to ensure that your company is accurately represented in the public domain. This can impact your company’s reputation and its ability to attract investors, partners, and clients. By keeping your confirmation statements current, you demonstrate your commitment to transparency and good governance.

Steps to File a Confirmation Statement

-

Log in to the Companies House Web Filing Service: Ensure you have your authentication code and company number ready.

-

Review Your Company Information: Before filing, review all the company details that will be included in the confirmation statement, such as registered office address, SIC codes, and shareholder information.

-

Update Any Changes: If there have been any changes in your company details since your last confirmation statement, update them before submission.

-

Submit Your Statement: Once you’ve reviewed and updated your information, submit the confirmation statement online. You will also need to pay the required filing fee.

-

Keep Records: After filing, keep a copy of the confirmation statement for your records and note the filing date for future reference.

Common Mistakes to Avoid When Filing a Confirmation Statement

Filing a confirmation statement might seem straightforward, but even a small mistake can lead to complications, delays, or penalties. To help you avoid these pitfalls, we’ve compiled a list of common errors that business owners often make when filing their confirmation statements. By being aware of these mistakes, you can ensure a smooth and successful filing process.

Mistake 1: Not Updating Changes Before Filing

One of the most critical aspects of filing a confirmation statement is ensuring that all your company’s information is up-to-date. Failing to update changes in your company’s directors, shareholders, or registered office before filing can result in inaccuracies in the public register. This not only reflects poorly on your company but can also lead to fines or legal issues. Always review and update any changes before submitting your confirmation statement.

Mistake 2: Missing the Filing Deadline

Timeliness is essential when it comes to filing confirmation statements. Missing the filing deadline can result in penalties and may even put your company at risk of being struck off the register. To avoid this, mark your calendar with the due date and set reminders well in advance. Remember, you must file a confirmation statement at least once every 12 months, even if there are no changes to report.

Mistake 3: Incorrectly Reporting Share Capital

Another common error is incorrectly reporting share capital in your confirmation statement. This section requires careful attention, as any discrepancies can lead to confusion or legal complications. Double-check your share capital information, including the number of shares, class of shares, and nominal value, before filing to ensure accuracy.

Mistake 4: Ignoring SIC Codes

SIC (Standard Industrial Classification) codes are used to categorize your company’s business activities. When filing your confirmation statement, it’s important to ensure that the SIC codes accurately reflect your current operations. Using incorrect or outdated SIC codes can lead to misrepresentation and may impact your company’s compliance status.

Mistake 5: Forgetting to Pay the Filing Fee

Filing a confirmation statement isn’t complete without paying the required fee. Forgetting to pay this fee can result in your statement being rejected, leading to unnecessary delays. Make sure to have your payment method ready when submitting your confirmation statement online to avoid any hiccups.

How to Correct Errors in a Filed Confirmation Statement

If you’ve already filed your confirmation statement and later realize there’s an error, don’t panic. You can correct the mistake by filing a second confirmation statement with the corrected information. However, it’s best to get it right the first time to avoid any complications or additional fees.

Conclusion

Filing a confirmation statement is a critical responsibility for any UK business owner. By avoiding common mistakes like not updating changes, missing deadlines, and incorrectly reporting information, you can ensure that your company’s details are accurate and up-to-date on the public register. This not only keeps your business compliant but also enhances its reputation and trustworthiness. Remember, the key to a successful filing is careful preparation and attention to detail.